What Happens If I Forget to Tax My Car?

Yes, having an untaxed car can be considered a criminal offence in most circumstances and fines are a common response. The amount you have to pay will rise the longer you leave it, so it's best to sort out your late tax as soon as possible.

Last updated: 23rd October, 2025

Award-winning CEO driving growth and social impact across automotive, recycling, and technology-led enterprise platforms.

Listen to this story

Are you worried about the financial and legal repercussions of failing to pay your car tax? Learn the penalties for forgetting car tax payments and the steps you can take when the DVLA gets involved.

The first step is to do a car tax check. It’s free and easy, helping you to understand:

- Your car tax band

- The tax expiry date

- The CO2 emission level

Another thing you can do is familiarise yourself with official government resources like Gov.uk, which are great for troubleshooting queries.

The site updates whenever new regulations are put in place, so you can avoid getting caught out. We've gone through the latest rule changes and compiled them here to make things easier for you.

What's in this article

Why Forgetting the Car Tax Is a Serious Issue in the UK

Almost all vehicles used on Britain's roads need to be taxed. There are exemptions from vehicle tax, but even if you don't have to pay anything on your car, you're still required to tax it. The government takes this issue seriously for several reasons.

The tax funds important public services, such as maintaining road infrastructure. Without this funding, roads can become unsafe. This system ensures that everyone pays a fair contribution to the upkeep. When people refuse to pay, it can negatively impact the driving population as a whole.

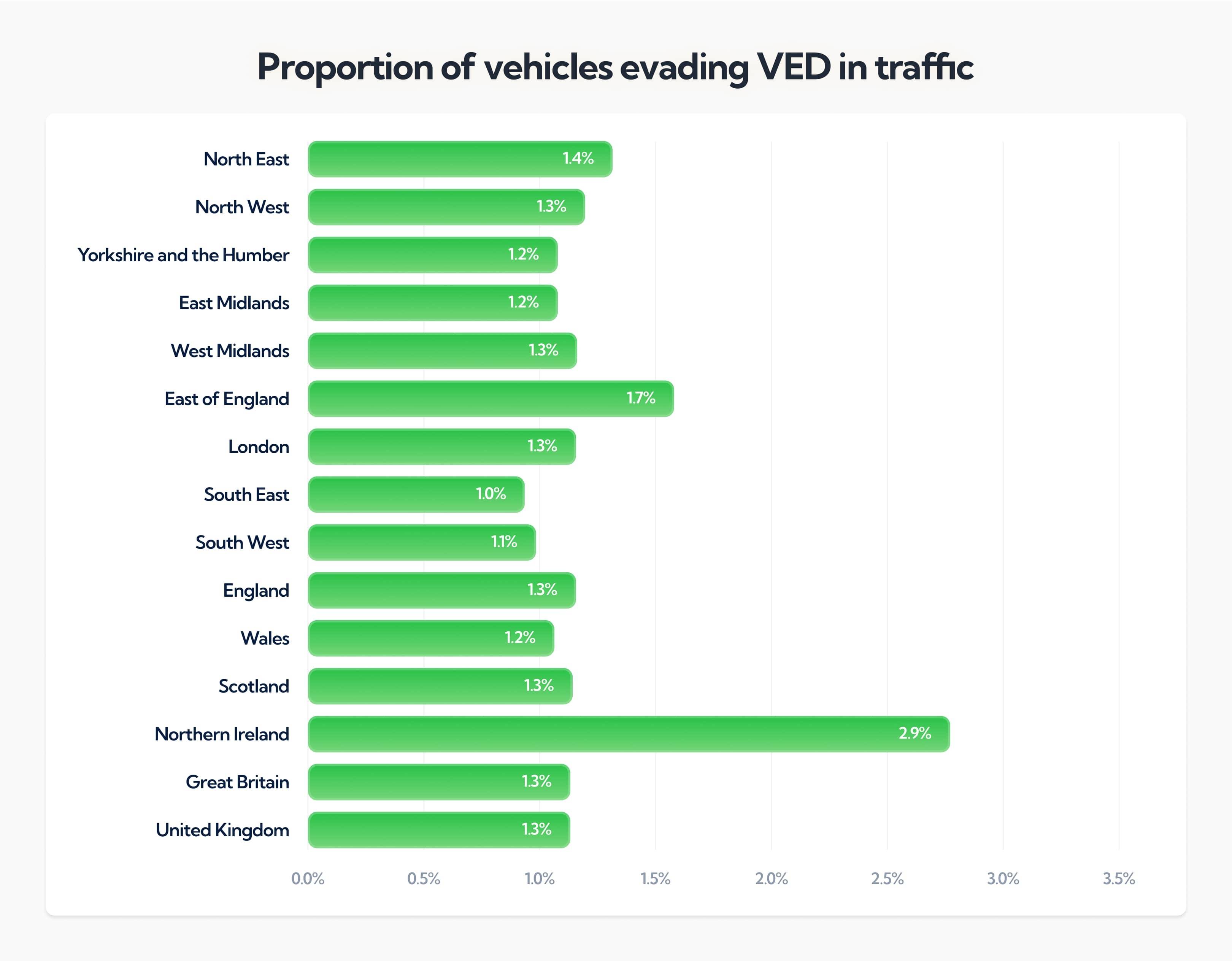

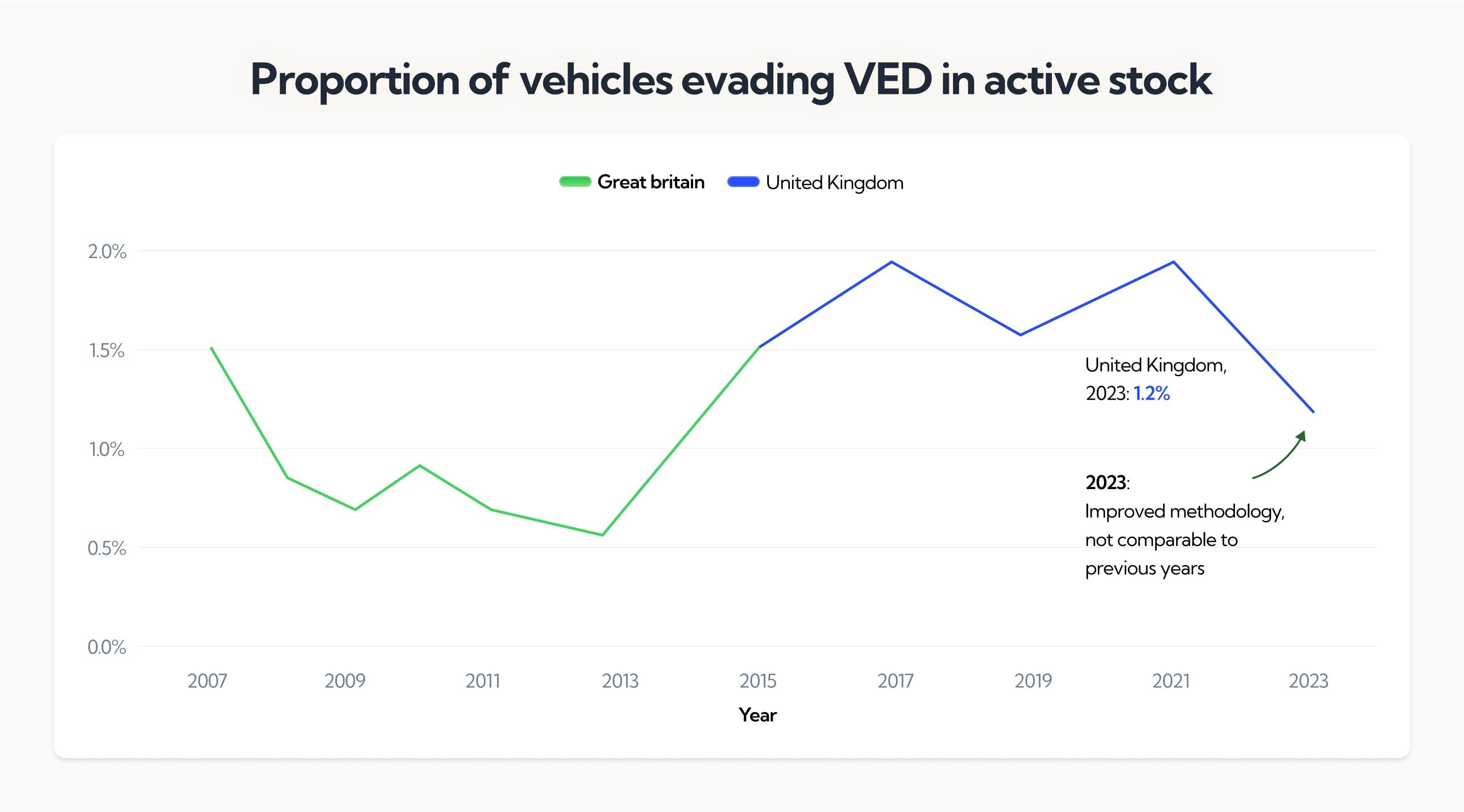

The graphic above from the DVLA shows that untaxed vehicles make up a very small percentage of road users. The graph below also shows a decrease due to improvements in methods for detecting them. In short, if you drive an untaxed car on a public road, you'll soon be found out and penalised.

In recent years, the tax has targeted cars with high emissions. This is to encourage drivers to switch to more environmentally friendly options. It's hoped that more people will drive cars that minimise pollution in the future.

It also ensures that every car is roadworthy, keeping everyone safer. Taxed cars need to undergo checks like an MOT to ensure they don't have any dangerous faults. After these checks, the car can be insured. It helps to set a standard for road vehicles.

The government takes any form of tax evasion very seriously and must be strict so that people don't avoid paying. Lapses in tax renewals are closely monitored, and the DVLA quickly reminds the person.

What the experts say

Anthony Sharkey

What Happens If You Miss Your Car Tax Renewal?

Once the issue is flagged, the DVLA will send you a warning letter. Before this happens, you will likely already have received a reminder letter 4 to 6 weeks before the tax needs to be renewed. Warning letters give you information about the possible penalties that you could incur if you don't get your tax sorted out.

Ignoring the warning will result in a fine being issued, which can be reduced if you pay within the first fortnight. You can also be immediately fined if your car is identified on public roads.

If you do nothing, things will escalate, and you could have your car clamped or impounded. In extreme cases, you can be summoned to court and be prosecuted.

Fines and Penalties for Untaxed Cars (2025 Updated)

The latest penalties for not taxing your car are as serious as they've ever been. Failing to tax your vehicle will result in the following:

- Initial fixed penalty notice (£80) - This is the first fine the DVLA will issue. Luckily, you can reduce it to £40 by paying within the first 14 days. It's wise to do so to avoid escalating the issue.

- Daily penalty charges if ignored - This can be up to £1 each day. Although this might seem low, it will soon add up the longer you ignore it.

- Vehicle clamping, towing, and seizure risks - If you fail to respond to the DVLA's notices, the car can be clamped. This comes with the further cost of having to pay for its release. If the car gets impounded, you'll need to pay for its storage and release. These fees tend to get higher the longer the car is seized. If you don't recover the car, it could be sold or even destroyed.

- Court summons and heavier fines for repeat offences - Continuing to ignore the DVLA will escalate the situation and lead to you attending a court hearing. As a result, your fines can further increase, and you may have to pay for court costs. In extreme circumstances, repeat offenders can be criminally convicted..

Can You Avoid a Fine If You Forgot to Tax Your Car?

Only in certain scenarios. Back in the days of paper tax discs, a five-day grace period was in place for untaxed cars, but this is no longer the case. Now that online tax is the norm, you'd technically be committing an offence the day you miss the tax due date.

As a result of the old ways it is a common misunderstanding to assume you have a few extra days before you can get fined. In recent years the DVLA has become increasingly strict.

Thanks to automated camera systems on roads, an untaxed car can be spotted quickly.

However, if you haven't driven the car since its renewal lapse, you can avoid this by paying the tax immediately. Once the issue has been resolved, the penalty process may be stopped.

Another option is to declare your vehicle as SORN (Statutory Off Road Notification). This shows the DVLA that your car will not be driven or kept on public roads, so you won't need to pay road tax.

You can do this online or by post. The process is very straightforward, and you won't need to provide documents like an MOT or insurance.

However, you need to be aware that once you declare the car as SORN, you will no longer be able to drive it on public roads until it has been taxed. Make sure it is stored correctly on private property.

Insurance and Legal Risks of Driving Without Tax

The vast majority of insurance policies require your car to be taxed. If you don't tax it, the policy will be void, so you won't have any more coverage. This will happen even if you get into an accident where you're not the one at fault. It's illegal to drive an uninsured vehicle on the road.

It can lead to more fines, points added to your license, and even a ban from driving. Getting caught without tax or insurance also leads to penalties, so it's a good idea to have both on your car.

When you decide to sell your car, the buyer can check to make sure it's road safe and fully taxed. Since untaxed cars are illegal to drive, they will be much harder to sell. Buyers might also be put off if they have to deal with any issues related to backdated taxes. Overall, an untaxed and uninsured vehicle has a lower value, and driving one on public highways is illegal.

Steps to Take If You Forgot to Tax Your Car

The important thing is not to panic. While you will likely be fined, you can avoid further penalties by taking immediate steps. For example, use Gov.uk to check your current tax status. Entering your registration number will be required.

The information displayed will include whether the car is taxed, when the tax expired, how much you owe, and whether it's declared SORN. This will help you to understand whether the tax lapse is just a few days or longer.

The next step is to reinstate your tax as soon as possible, ideally on the same day. Whatever you do, don't drive the untaxed car until the problem has been resolved and you know it's road legal again.

It’s very important to know how to tax a car and the different methods for doing so. Luckily, the process is more convenient than in the past, thanks to direct money transfers and instant tax processing.

How to Tax Instantly Online

This typically takes 5 to 10 minutes to complete and can be done from home. It's available via the DVLA site and can be done at any time of the day. You simply:

- Access the site and have your key information handy. This can include your reminder letter, registration number, and MOT certificate.

- Choose a payment plan.

- Follow the onscreen prompts.

- Complete the transaction. You'll receive a confirmation email. Once the payment has gone through, your car will have been officially taxed.

How to Tax at the Post Office the Same Day

This is fairly straightforward. You'll need to:

- Bring along necessary documents such as your V5C Registration Certificate (Logbook), MOT Certificate (if applicable), and insurance information. You'll also need to provide payment for the car tax.

- In advance, check that the post office branch offers car tax services. This can be done online or by phone.

- When at the post office, let them know you want same-day instant taxing. Then, tell them the monthly payment option you want. This can include 12 months, 6 months, or monthly payments. You can make the payments via direct debit, so they are not forgotten.

- Once the payment is complete, the DVLA will tax the car right then and there. You'll be able to legally drive back from the post office.

- Keep your proof of payment. It will be useful in case you need it to renew your insurance or settle any DVLA queries in the future.

What to Do If You Already Received a Fine

Now that you know all of the complications associated with ignoring payments, you'll realise it's best to resolve the situation as quickly as possible.

First, read the fine notice carefully and make sure you understand how much you owe and why it was issued in the first place. Then, check the deadline for payment reduction and try to pay the fine within that time frame to save money.

You could choose to appeal the fine, but the outcome would depend on the strength of your case. If the DVLA genuinely made an error, an appeal may be successful. However, if you simply forgot the due date, you'll likely lose the case and still have to pay.

How to Prevent Car Tax Problems in the Future

Organise your tax cancellation ahead of time if you plan any vehicle changes, such as:

- Selling the car

- Buying a new one

- Switching it to off-road

It's important to be aware of car tax changes. You can do this by checking the DVLA site and swiftly opening any letters you get from them. It's never a good idea to ignore their notices.

You can sign up for free DVLA reminders so that you always remember payment dates. It's also a good idea to keep the tax payment date in your personal digital calendar and set alerts. This is much more efficient than relying on your memory and paperwork. If you set an alert a week before the deadline, you'll have plenty of time to act.

A lot of people choose to make their payments through direct debits so that the tax will automatically renew. Remember to change car tax direct debit if you know you don't have enough funds for the next tax payment. This will prevent the tax from lapsing and stop you from getting the £80 late fee.

Each time you tax your car, you'll need your V5C Logbook handy, so keep it safe and up to date. If you move house or change your name, you should update the V5C. If not, you could miss important DVLA letters, potentially leading to you missing your tax deadline.

It's important that you know the right tax rates for your specific vehicle. When you first register, the rate will be based on its emission level. Here are the current first-time tax amounts for UK cars:

These payments cover the car for the next 12 months. It's also important to note that if the vehicle's listed price is above £40,000, you'll need to pay an extra £425 per year, unless it's a low-emission vehicle or registered before 1 April 2025. The listed price is the value before any discounts were applied to it.

The Bottom Line

If there's one phrase worth keeping in your head, it's this: The sooner you get it sorted, the easier things will be.

You now know the different ways to tax your car and the penalties incurred for forgetting to do so. Whilst the DVLA can send you reminders, it's ultimately up to you to know when and how much to pay. Know these facts in advance and be prepared so you don't get caught off guard.

Frequently asked questions

It can happen fairly quickly, especially if you're driving the vehicle. Thanks to automatic plate recognition technology, an untaxed car can be spotted on the road and instantly fined.

No, you can still be fined in this situation. However, you can drive your car on public roads if you're travelling to get an MOT test.

For road vehicles, most UK insurance companies will only accept legally taxed vehicles. The provider could refuse to pay out if you get into an accident in an untaxed car, as the coverage will not have been valid. However, you can insure a car without tax if it's for off-road use. SORN insurance can cover damage and theft.

Yes, they have the authority to do this for a number of reasons, including tax-related ones. They can even clamp the car on private property.

You'll continue to be pursued by the DVLA. As well as new fines, you could face court action and potential criminal conviction. Your vehicle may be seized and its insurance invalidated.

Yes, starting in April 2025, these vehicles will be required to pay vehicle excise duty. This tends to be £195 per year for most e-vehicle drivers. If this is missed, the driver is subject to the same fine as non-EV vehicle drivers.

No, your car tax has to be renewed before the due date. Backdating it will not allow you to avoid any penalties. This is why it's very important to know the date your car is coming up for renewal.

Whilst it doesn't invalidate past fines, it does mean you'll avoid future ones. SORN means you can cancel the car tax as the vehicle won't be used on the road.

You'll be required to register your vehicle as SORN if:

- It's not taxed or insured

- You plan to scrap it

- You've just purchased or received it and want to keep it off-road

This can lead to very serious consequences, which will get worse the longer you leave it. These can include:

- Late Licensing Penalty (LLP)

- Out-of-Court Settlement (OCS)

- Debt collection agency referral

- Court summons

- Vehicle clamping

- Blocking of your direct debit payments

The good news is that the DVLA keeps you informed if you accidentally miss a payment. When this happens, it's a good idea to pay the tax as soon as possible so that you don't have to worry about these penalties.

About Car.co.uk

Share on

Latest news & blogs