How to Change Your Car Tax Direct Debit (Full Walkthrough)

In this guide, we’ll talk you through the stages of changing your direct debit so you can stay on top of your car tax. You’ll learn the reasons why you might need to change it, the methods for doing so, and the potential obstacles you may face. It’s very important that you keep your tax up to date so that you can avoid fines.

Last updated: 23rd October, 2025

Award-winning CEO driving growth and social impact across automotive, recycling, and technology-led enterprise platforms.

Listen to this story

Before you start, you might have questions like:

- How much is my car tax?

- Can I tax a car without V5 documentation?

- What’s my tax expiry date?

- What emission band is my car in?

You can use car.co.uk as a resource for learning the answers. It will allow you to check your car tax so you’re prepared when it comes time for payment. Simply enter your registration to get essential insights.

Let’s assume you're already an active car taxpayer who uses direct debit as your payment option. Eventually, you’ll likely need to make adjustments to it. We’ll walk you through the process using the DVLA’s latest regulations.

What's in this article

Why Do So Many Drivers Use Direct Debit for Car Tax?

Because it’s so convenient. Having an automated payment system means you’ll be less likely to forget taxing your car, so you won’t need to worry about potential penalties. As long as you have the correct amount of funds in your account, the payment will be taken without you having to do anything, giving you peace of mind.

What the experts say

Anthony Sharkey

Not everyone finds a one-time lump sum financially feasible. They will want to pay the tax off in monthly instalments. At the same time, they may worry that they'll forget the renewal date. Luckily, a direct debit takes the money out automatically. It minimises the risk of human error and gives people with tighter budgets the chance to spread out the cost.

Some people find it inconvenient to deal with taxes through their local post office. They may be put off by long queues and lots of paperwork. If you prefer contactless and digital services, you'll find direct debits appealing as everything will be done through the phone or online.

If you want to keep your car long-term, then it makes sense to plan out your tax payments in advance. Automated bank transfers on specific tax dates will future-proof your vehicle ownership. The DVLA sends out reminder letters so you can check the money is ready in your account.

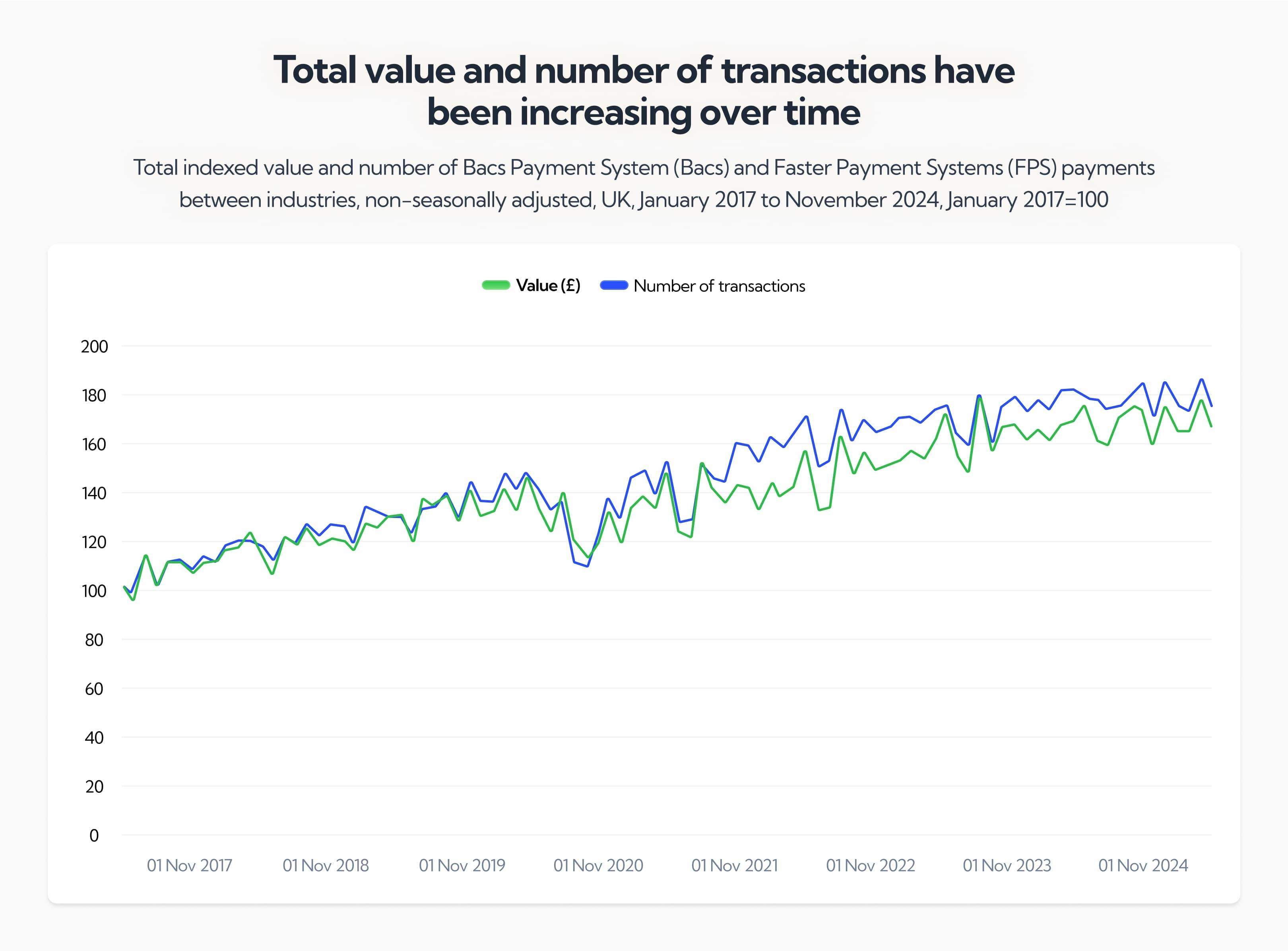

Another factor is safety concerns. People want their payment system to be trustworthy and reliable. Bacs (Bankers' Automated Clearing Services) is considered one of the safest options. It’s become an industry standard that continues to grow in popularity, as shown by the graph below from the Office of National Statistics.

The DVLA introduced car tax direct debits in 2014, and paper tax discs were abolished at the same time. This signalled a shift to a more digitised way of processing tax payments, which the general public has embraced.

When Do You Need to Change Your Car Tax Direct Debit?

There are a number of situations where you’ll need to make a change, which we’ll explore:

- You switch to a new bank. If you have set up a new account, you'll need to give the DVLA these updated details.

- You sell the car. In this situation, your existing direct debit will automatically be cancelled.

- You buy a new car. Even if you previously had a direct debit for the old car, you'll need to set up another for this new one. You'll also be required to get a V5C Logbook or a new keeper slip.

- You have insufficient funds. When this happens, the tax payment will fail. It's important to sort this out quickly to prevent escalating fines.

- You have a change in personal circumstances. If a divorce/separation causes changes to the account ownership, then you may need to adjust your direct debit so that it's in the correct account holder's name.

- You are mandated by the DVLA. This could be for a variety of reasons. If so, it's best to create a new direct debit as soon as possible.

If your car tax changes for whatever reason, the DVLA will notify you. This doesn’t necessarily mean you’ll be required to change your direct debit. It will depend on your specific circumstances.

Step-by-Step Guide to Changing Your Direct Debit Online

- Cancel your existing direct debit. This can be done through your banking app.

- Wait a couple of days for the cancellation process to complete. As soon as you know it has been registered by the DVLA, move on to the next steps.

- Access the DVLA car tax page and log in using a reference number.

- Choose "Pay by Direct Debit" and your frequency of payment. Then enter the bank details for your new account.

- Double check everything is correct then submit the request. Within a few days the DVLA direct debit should be listed by your bank.

Make sure you do all this before the date of your tax payment.

Logging Into DVLA’s Car Tax Service

The DVLA car tax page is easy to use. It will guide you through how to tax a car so you can prevent any fines. First, you’ll need the following:

- The latest Vehicle Log Book (V5C) in your name

- New Keeper Slip (V5C/2) if you've recently bought the car

- DVLA Tax Reminder Letter (V11 or V85/1), which would have been sent to you by email or in the post

These will contain reference numbers so you can access the tax page.

Then follow these instructions:

- Click "Start now"

- Enter your reference number

- Confirm your car details

- Check that the vehicle make, model, and emissions information are all correct

- Choose your tax duration. This could be 6 months or 12 months, with options of paying in an upfront lump sum or through monthly instalments

- Pay the tax using your direct debit. Check that you have received a confirmation email

If you don't have a reference number you'll need to request a new Logbook. This tends to cost £25. New car owners can choose this method or use a V5C/2 slip. if the V5C is in someone else's name you won't be able to use it for taxing your car. It will need to be updated first. Tax cannot be transferred between owners. Only the new owner can tax it.

Entering Vehicle and Payment Reference Details

For taxing vehicles, you'll be asked for a reference code from one of the following:

- V11 Tax Reminder Letter (16 digits)

- Vehicle Logbook (V5C) (11 digits)

- New Keeper Slip (V5C/2) (12 digits)

The bank will provide you with a reference number or mandate ID when you set up a direct debit. This can be used to manage your payments, but the DVLA will not usually require it during the taxing process.

Updating Bank or Card Information

You could contact the DVLA through their telephone helpline (0300 790 6802), as you can't change bank details through their site. You'll need to provide:

- Your vehicle registration number

- Your name and address

- Old and new bank account details

The DVLA can then manually update your direct debit.

Confirming the New Direct Debit Setup

Once you've submitted the new direct debit details to the DVLA, you can check it's been successfully set up by reading the confirmation email. The DVLA will also send out a confirmation letter to the address you provided. It can take several days to arrive.

The letter and email will contain important information such as your payment method, the amount, and its frequency. If you don't receive this confirmation within 7 working days, you should call the DVLA helpline (0300 790 6802).

You can also log in to your bank account and confirm that the payment has been scheduled. It will appear within a few days of the direct debit setup. These payments are taken out on the 1st of each month, so note the dates you need to pay and ensure the account has the right funds.

How to Change Your Car Tax Direct Debit by Phone or Post

The DVLA helpline (0300 790 6802) is open:

- Mon to Fri: 8am to 7pm

- Sat: 8am to 2pm

You'll need one of the previously stated documents (see Entering Vehicle and Payment Reference Details section above). DVLA staff will accept your request to cancel the old direct debit. However, they won't be able to take your new account details on the phone as this breaches data protection laws.

Instead, they can guide you through the process of changing your direct debit online. They might also send you forms to fill in if you'd prefer a more traditional method. You can also cancel your direct debit by sending a letter to:

DVLA Vehicle Customer Services

Swansea

SA99 1AR

It will need to include:

- Your name and address

- Your cancellation request and a reason for it (such as switching bank accounts)

- Your registration number

- Your signature

Unfortunately, you won't be able to set up the new direct debit by post. The good news is the online process is straightforward and doesn't take very long to complete.

How to Cancel Your Car Tax Direct Debit

There are two main options: through your bank or the DVLA.

To cancel car tax through the bank you could log in to your online account, find your "Direct Debits" or "Regular Payments" and select the DVLA or Vehicle Licensing for cancellation. This can also be done on the phone and the bank will be required to cancel it upon your request under the Direct Debit Guarantee.

Cancellations through the DVLA can be done via the phone or by post (see How to Change Your Car Tax Direct Debit by Phone or Post section above).

Common Problems With Direct Debit Changes

This process is easier and more convenient than it has been in the past. However, there are still a number of common issues that could trip you up. Let’s imagine you’ve encountered one of the following common problems and learn the ways it could have been prevented:

You didn't cancel the old direct debit but still set up a new one. As a result, you've got a conflicting mandate or payment error.

Solution: Always check with your bank that the original direct debit is cancelled so that the old transfer won't go through. Never create a new one until you're sure the old mandate is cancelled.

You've waited too long to set up the mandate. This means your car could become untaxed, and you'll face a £40 fine if you drive it on public roads.

Solution: As soon as you've stopped your old direct debit, create a new one. Don't wait too long and always be mindful that taxes are due on the 1st of the month.

Your first payment has failed because you have insufficient funds, and your car is now illegal to drive.

Solution: Plan ahead by ensuring that you always have the right amount in your account. Set reminders so that you can transfer funds into the account in time for tax day.

You gave the DVLA the wrong reference number because you were using an incorrect V5C Logbook. Now the direct debit has been applied to the wrong car.

Solution: Check that your Logbook is up to date and that your reference number is correct.

You've bought a used car, and the previous owner's direct debit has been automatically cancelled. You didn't pay tax on it yourself, so now it's illegal to drive the car.

Solution: When you buy a car, immediately set up a new tax using the V5C/2 slip.

You've been trying to change details on your existing direct debit. It's a time-consuming process, you seem to be getting nowhere, and the DVLA refuses to allow these changes.

Solution: Remember that you need to cancel existing direct debits and start a new one from scratch.

You don't know if you've been taxed, as you haven't received a letter or email confirming it. As a result, you're worried you might get penalised.

Solution: Use the DVLA website to check your tax status. Contact the bank to make sure the payment has been processed.

You have decided to cancel the mandate due to a minor issue, such as changing your phone number. You realise this was unnecessary and could interrupt your tax payments.

Solution: Only make this cancellation if there is a change to your bank details or vehicle.

Final Thoughts

Direct debits continue to be a very popular method for paying tax. It's safe, convenient, and allows you to pay in instalments. You might assume that changing your car tax direct debit is a small bit of admin. However, it's important to remember that there are financial and legal consequences if you don't do it correctly.

Remember to act early and be prepared for the payment date. It's never a good idea to leave things till the last minute. If a payment is accidentally missed, your car will become untaxed. This can lead not just to fines but vehicle clamping and even seizure.

In recent years the DVLA has focused on making this process easy to do online. It should take around 10 minutes if you have all of the necessary documents handy.

Use Car.co.uk to better understand your car tax and finance information. Gain key insights so that you can choose your ideal next car. You can even get a quote if you plan to scrap your old one. The more informed you are about the motoring industry, the better equipped you’ll be to find the best deal.

Frequently asked questions

Unfortunately, no. All payments are taken on the 1st of the month. This is fixed by the DVLA and can't be changed. It applies regardless of whether you pay in monthly, biannually or yearly instalments.

There isn't any flexibility when it comes to the date the funds need to be transferred, so make sure you have enough money in your account on the day. The DVLA system batches all VED (Vehicle Excise Duty) payments together for the sake of simplicity and security.

When you set up a new direct debit mandate with the DVLA it typically takes 1 to 3 working days to be processed. It may take 2 to 5 working days for the direct debit to appear in your bank account.

It can lead to serious financial and legal consequences. Your car will no longer be taxed and, therefore, will be illegal to drive on public roads. If you are caught driving it, you'll receive an £80 fine. If you leave it more fines will accumulate and your car could be clamped.

No, the DVLA does not allow you to change your payment frequency midway through your existing tax year. Once the direct debit is active, you'll need to stick with the payment plan or set up a new direct debit.

No, you don't need to manually Stop paying tax on a car as the DVLA will automatically cancel the direct debit once they've been notified that vehicle has been sold. You can inform them through the DVLA website or by post. Once the tax has been cancelled, you'll be refunded for any unused months.

No, you won't have to worry about any additional fees. The only additional cost to consider is the fact that a monthly or biannual payment plan can be slightly more expensive than a yearly upfront lump sum. Factor this in when changing your direct debit.

Yes, you can cancel any time and switch to a full annual amount instead. You can do this online or on the phone through either the DVLA or your bank. You should cancel before the next payment date to avoid unwanted charges, then re-tax the car with a full payment. This will be a completely new direct debit, and the old mandate won't carry over. Make sure the new tax begins after the current period ends to avoid being double charged.

This will lead to your direct debit failing, and the DVLA will cancel your car tax. This happens automatically when a payment does not transfer properly. You may not be notified of the change right away, leading to unknowingly driving the car illegally.

You might be saying to yourself, “I forgot to tax my car. Will I get fined?” Unfortunately, this will likely be the case. Avoid this penalty by having the funds ready to go in your account beforehand.

If you cancel it before a payment is due or the DVLA cancels it due to a failed payment, then yes. However, the vehicle won't immediately be untaxed if you cancel the direct debit directly after the current month's tax has been paid. You'll have until the next payment deadline before it becomes untaxed.

About Car.co.uk

Share on

Latest news & blogs